Sourcing furniture in bulk from China might seem like a straightforward way to cut costs. But as a manufacturer with years of experience in global trade, I’ve seen how hidden costs can catch even seasoned buyers off guard.

Hidden costs such as VAT, shipping fees, and import duties can add 30%-50% to the initial price, impacting profitability if not planned carefully.

These unexpected expenses can turn a great deal into a financial headache. Let me break down these costs and help you avoid unpleasant surprises.

What Is the Tax on Furniture Imported from China?

One of the first things to consider when importing is tax. Import taxes can vary depending on your destination, but they are a significant expense in Europe.

In Europe, VAT is set at 20% of the landed cost, while customs duties on furniture range between 3%-10% based on the product’s classification.

Dive Deeper into European Taxes

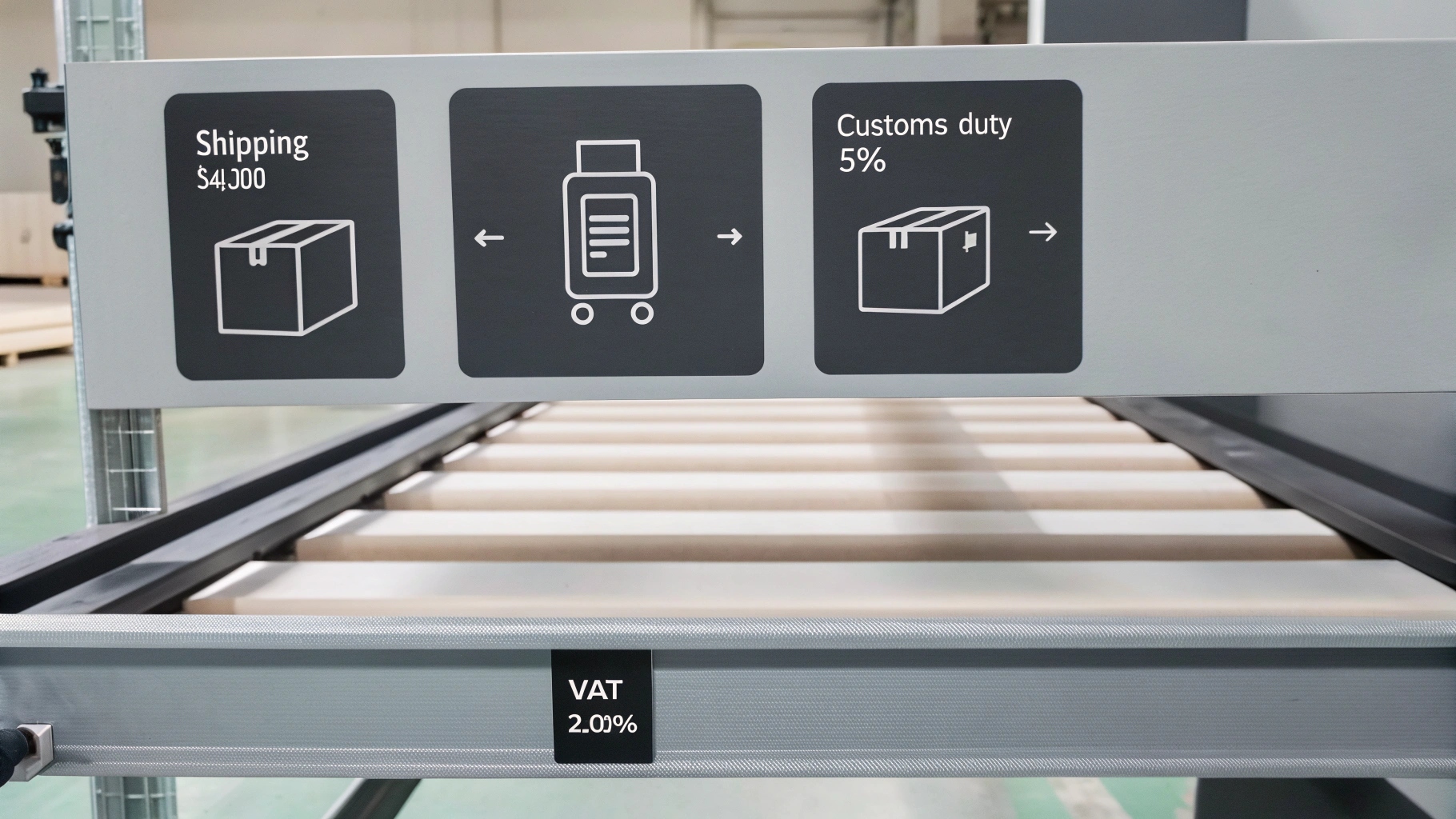

Let me illustrate how VAT and duties impact the landed cost. The landed cost includes:

- Product Value: The amount invoiced by the supplier.

- Shipping Costs: Freight charges to your destination.

- Customs Duties: Calculated using the HS code of the product.

For example, here’s a breakdown of a shipment valued at $15,000:

| Item | Cost |

|---|---|

| Product Value | $15,000 |

| Shipping Costs | $4,000 |

| Customs Duties (5%) | $750 |

| VAT (20% of total) | $3,150 |

| Total Landed Cost | $22,900 |

Understanding these calculations ensures you’re prepared to handle taxes without impacting your margins.

What Costs Are Involved in Importing from China?

Aside from taxes, importing furniture involves several additional costs that can add up quickly. I’ve seen businesses underestimate these and end up with unexpected expenses.

Shipping, customs clearance, VAT, and local delivery can increase the total cost by 30%-50%, depending on your destination.

Dive Deeper into Common Costs

Here’s a detailed breakdown of typical costs:

-

Shipping Costs

- A 40-ft container to Europe costs $3,500-$5,000 depending on the route.

-

Customs Clearance

- Clearance fees are typically $400-$600 per shipment.

-

VAT

- Adds 20% to the total landed cost in most European countries.

-

Port Handling Fees

- Ports charge $300-$500 for handling and processing.

-

Insurance

- Freight insurance costs around $30-$50 per shipment.

-

Local Delivery

- Transport from the port to your warehouse can cost $800-$1,000.

As a manufacturer, I always encourage buyers to consider these costs during price negotiations and planning.

Is It Worth Buying Furniture from China?

I’ve worked with businesses that hesitated due to the hidden costs of importing but later realized the overall savings outweighed these challenges. Let’s break it down.

Despite taxes and logistics expenses, Chinese furniture remains a cost-effective choice due to lower manufacturing costs and flexible customization options.

Dive Deeper into Cost vs. Value

Here are the benefits of sourcing furniture from China:

- Lower Manufacturing Costs: Even after including additional expenses, the final price often remains below local production costs in Europe.

- Customization Options: As a manufacturer, we offer tailored solutions such as custom designs, branding, and specific material choices to meet your market’s needs.

Challenges:

- Quality Issues: Weak materials or inconsistent finishes can harm your brand. Partnering with reliable suppliers like us, who offer thorough quality checks, is essential.

- Logistics Delays: Delays at customs or in transit can disrupt your supply chain.

Pro Tip: Invest in pre-shipment inspections and work with suppliers experienced in global logistics to mitigate risks.

Conclusion

Hidden costs like taxes, shipping, and customs fees can make bulk purchasing from China more expensive than anticipated. However, with careful planning and a reliable supplier, these challenges are manageable.

Key Takeaway: Understanding and preparing for these costs ensures a smoother importing experience and better profitability for your business.